Introduction

The speed and scale of the energy transition is becoming more obvious every day, causing more investors to accept the need to improve their strategies to be well positioned as structural changes in the energy and related sectors occur. Whilst full transformation may take time, unanticipated changes in the supply-demand relationship can have material impacts in the short term. The markets are showing that even relatively small shifts in market share, (e.g. US coal power generation), or market size, (e.g. global oil oversupply), can have material impacts on financial performance.

This research has been developed in response to investor demand for understanding company level exposure to the energy transition. Many large pension funds, insurance companies and asset managers are looking at climate risk with greater scrutiny, which is reflected the interest seen by both the UN-supported Principles for Responsible Investment (PRI) from its signatories and Carbon Tracker from the investors it works with.

Climate change momentum has led to a number of investor-led initiatives, including:

- the Climate Action 100+ initiative;

- Carbon Asset Risk and Aiming for A resolutions;

- the Montréal Carbon Pledge;

- the Portfolio Decarbonisation Coalition;

- the Transition Pathways Initiative.

The range of approaches reflects the different investment strategies and prevailing investment cultures on different continents.

The focus on transition risk has been crystallised by the FSB TCFD. The taskforce has outlined how scenario analysis is a useful tool for regulators, financial institutions and non-financial companies to understand energy transition risk, and the increasing expectations around disclosure of this analysis.

The recommendations of the taskforce will start to feed through to company disclosures, with several companies already committing to implementing them going forward. This analysis demonstrates how feasible it is to apply this kind of simple scenario analysis to produce decision useful information on the oil and gas sector, and reflects the kind of disclosure starting to be seen from leading companies.

In response to these developments, this analysis has been developed to provide indicators of company exposure to the low-carbon transition. The approach of building up understanding of asset level data and integrating the relative economics of production options provides analysis which reflects how energy markets work, going beyond blanket approaches to allocating the carbon budget across an entire sector.

The numbers – focus on future production options

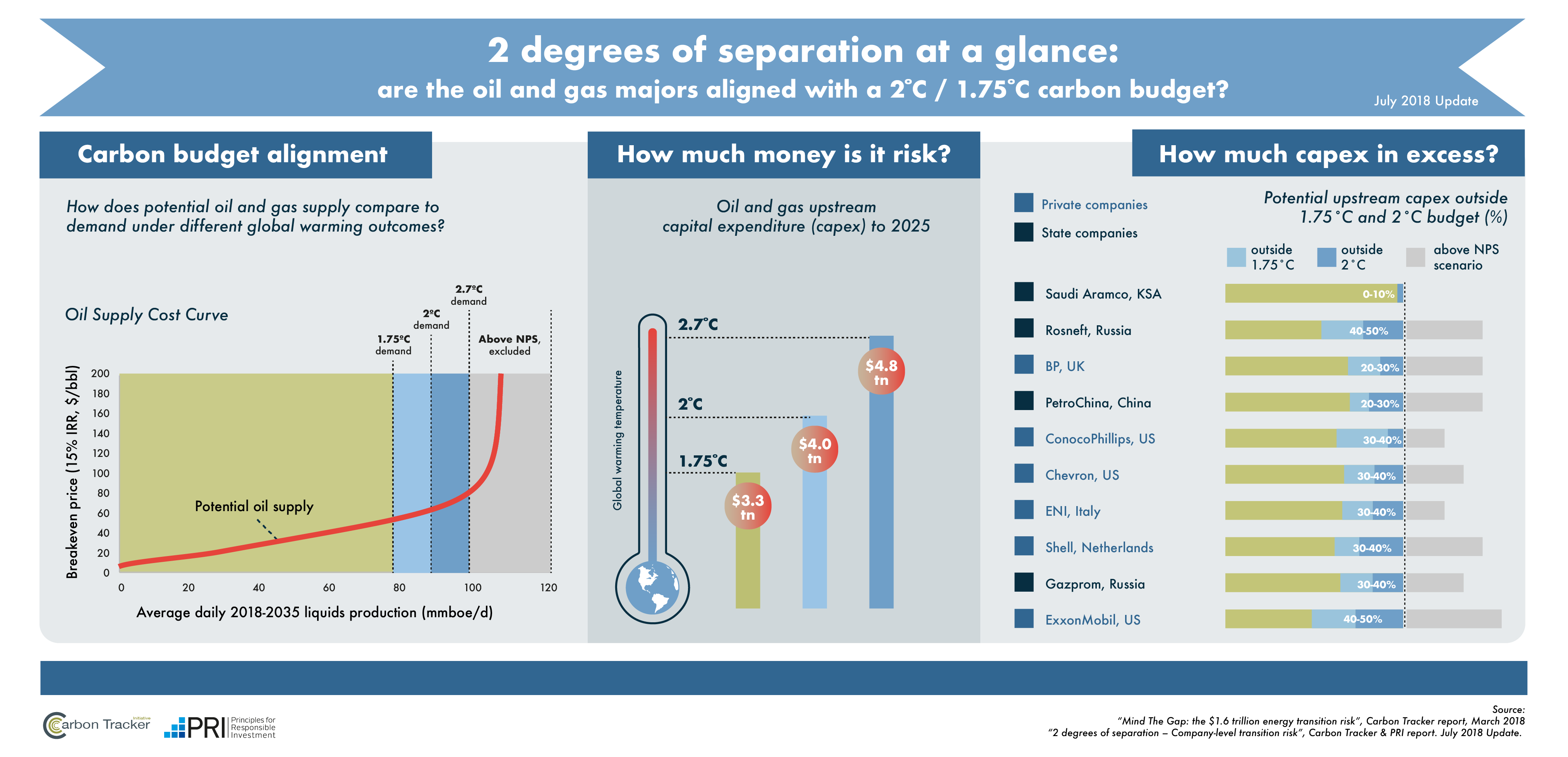

Since demonstrating the vast overhang of coal, oil and gas in the ground compared to a carbon budget to limit global warming to 2°C, Carbon Tracker has developed forward-looking indicators to understand the implications for individual companies. One of the most frequent reactions from investors is to ask who the winners and losers are under such a scenario.

Whilst simple reserve and resources numbers across all fossil fuels answered the macro question of whether there was exposure to unburnable carbon, a more sophisticated approach looking at production profiles is required to differentiate at a company level.

Carbon supply cost curves

Carbon Tracker developed its carbon supply cost curve approach as a consistent, objective basis to allocate fossil fuel projects as either within or outside a carbon budget based on each project’s economics. Once done at a global level, the results can be shown at the company level based on each company’s interest in those projects.

- Each fossil fuel is treated separately as each has its own regional markets, primary uses, and differing greenhouse gas intensities.

- Oil is treated as a single global market as there is sufficient global trading to justify this, whereas gas is split up into global liquefied natural gas (LNG), Europe and North America, on top of other domestic markets.

- For each of the main markets for each fuel, all the potential supply options are lined up in cost order and a demand intersect consistent with the scenario (carbon constraint) being analysed is applied.

- The economic logic applied is that the most competitive supply sources will be produced to meet demand, based on the relative costs of the projects.

- The relative cost of production of the supply options is based on a single industry database , Rystad Energy UCube; a complete, bottom-up upstream database with more than 65,000 E&P assets held by more than 3,200 companies.

For further details on methodology please see the appendices of the full report. While the precise cost levels of a specific project may be debated, it is the relative positioning of costs that is important for the purpose of this exercise. Supply costs change over time and the analysis will have to be updated to understand how the positioning of a company’s portfolio of projects is changing going forward.

The costs of any particular project may change due to a range of factors, including efforts to reduce cost by the operator through improved design, or the level of activity in the sector inflating or deflating contractor and equipment costs. Particular regions or technologies may also progress relative to others. For example, the standardisation of drilling technology has contributed towards reduced costs, especially in US shale, largely in response to the lower oil price seen in recent years.

For economies heavily reliant on hydrocarbon industries, (e.g. Venezuela, Russia), the change in oil price has also impacted currency valuations, which has affected the position on the cost curve when converted to US$. The exposure of companies to excess capex in a given scenario will also change as they sell and acquire interests in projects, undertake M&A activity at the corporate level, and explore for new discoveries.